The fear of online scams among women in West Africa is reshaping how millions of women interact with digital platforms. Across the region, the digital economy is expanding rapidly. Consequently, women can now access credit without visiting a bank, while fintech solutions continue transforming how they save, borrow, and run their businesses. This shift represents major progress. Yet, beneath this growth lies a persistent gender divide that affects how confidently women can participate online.

Countries such as Nigeria, Ghana, and Senegal have become hubs for digital innovation, with youthful populations, high mobile penetration, and resilient informal economies fueling this momentum. Yet, beneath this growth lies a persistent gender divide.

The Gender Gap in Digital Access

Despite increased digital activity, women remain at the margins. Many face lower smartphone ownership and limited digital literacy. According to the World Bank’s Bridging the Digital Divide report, gaps in access, usage, and digital skills reduce opportunities for women. Furthermore, GSMA estimates that more than 150 million additional women in Sub-Saharan Africa need to come online to close the mobile internet gender gap by 2030. Importantly, these disparities underscore the scale of intervention required to achieve gender parity in digital participation.

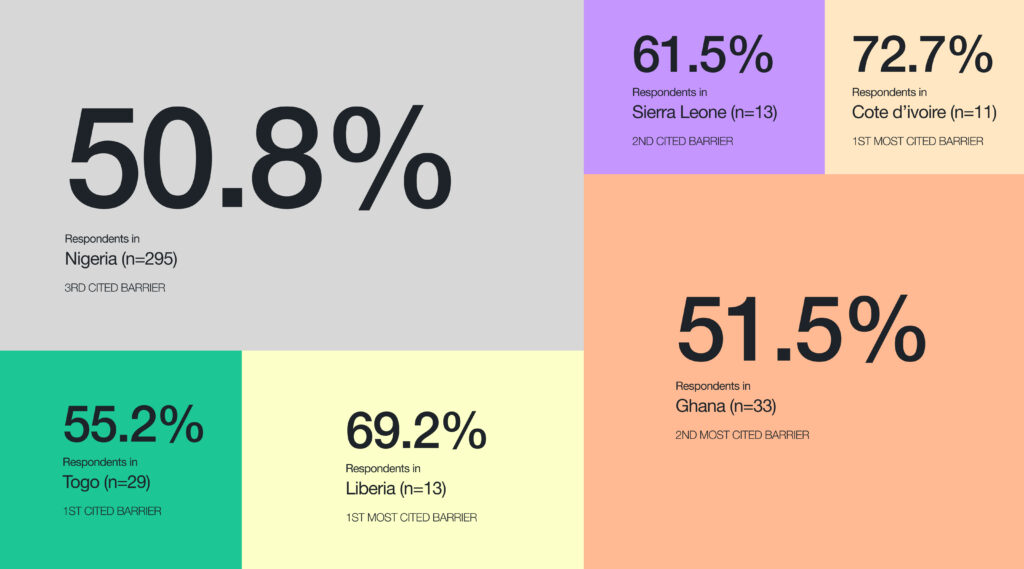

Recently, our team conducted a survey in eight West African countries. The goal was to understand barriers women face when using digital platforms. Across six of those countries, one challenge stood out clearly: fear of online scams and harassment.

Source: DODO’s survey of women in West Africa

Base: Women in West Africa aged 18+, who mostly reside in urban areas and have access to mobile phones. Percentages indicate the proportion of respondents who answered, “Fear of online scams and harassment” to the question, “What are the top three 3 challenges you often face when using apps or websites?”

Validated by Research

Research supports these findings. A 2022 CGAP study highlights agency fraud, where mobile money agents deceive customers during cash-in or cash-out transactions. These risks erode trust among women.

For example, in Zambia, a woman lost part of a mobile money transfer to a fraudulent agent. After this, she believed digital money should only be handled with the help of trusted family members. Our survey results reflect this same hesitation. Women consistently ranked scams, fraud, and harassment as top barriers to digital engagement.

Our survey results reflect this same hesitation. Women consistently ranked scams, fraud, and harassment as top barriers to digital engagement

The fear of fraud: what it means and why it resonates

The fear of fraud is not just a personal worry. It is a systemic barrier that limits inclusive economic growth. Fraud costs African economies an estimated $4 billion each year and reduces GDP by up to 10%.

For women in West Africa, the fear is amplified by the realities they face.

Limited Safety Nets and Higher Consequences

A financial loss impacts men and women differently. A man who loses ₦10,000 may recover quickly through social networks. For a woman who supports a family or runs a small business, the loss can threaten survival. Social blame often follows: “Why did you trust that link?”

This aligns with findings from a World Bank study on Nigerian women micro-entrepreneurs. These women operate on thin margins. Even small financial shocks can be devastating because they lack formal safety nets and face stigma for financial mistakes.

Lower Digital Literacy and Reliance on Informal Channels

Women often have fewer opportunities for formal digital training. Many rely on informal systems such as WhatsApp referrals, acquaintances, or local mobile money agents. These channels can be less secure and expose women to higher risks.

The UNCDF notes that low-income and rural women are particularly vulnerable to SIM swap fraud, social engineering, agent fraud, and data breaches.

Why Women Are More Susceptible, and More Vulnerable

It’s one thing to fear fraud; it’s another to be more susceptible to it. Several dynamics conspire here:

Trust Networks

Women often rely on social endorsements from friends and family when evaluating apps or services. While this builds support, it also exposes them to scams spread through trusted channels.

Cognitive Overload

Women frequently multitask and manage several roles at once. This workload reduces their capacity to examine every message or authorization request carefully, making them more vulnerable to social engineering.

The Gender Wage Gap

The wage gap creates economic vulnerability. According to the U.S. Bureau of Labor Statistics, women earned 83.6% of men’s wages in 2023. Until women gain equitable income and financial independence, they will remain disproportionately exposed to scams that exploit financial need and social trust.

How can we support women to overcome the fear of scams in West Africa

Overcoming the fear of fraud requires a multi-stakeholder approach beyond isolated projects to generate an integrated “trust infrastructure,” which must be built upon pillars such as; empowering users through education, safer product design, and using technology for proactive protection.

Effective support begins first by giving women the skills to protect themselves, empowering them with education along with community resilience.

Go beyond Basic Literacy to Fraud-Centric Education

Standard digital literacy training is not enough. Women need practical, fraud-focused skills. Programs should teach them how to identify phishing links, recognize romance scams, detect social engineering, and understand their consumer rights.

Several successful models already exist. For example, the World Bank’s Gina Mata, Gina Al-Umma program in Northern Nigeria integrates online safety into its digital training. Digify Africa’s Lwazi and Lesedi WhatsApp bots also teach users how to spot scams using low-data content.

Leverage Community Networks for Collective Defense

Formal education must be complemented by community-based approaches. Women’s savings groups and other local associations are highly trusted institutions within their communities. These existing networks can share information on preventing fraud and building collective resilience. By integrating digital safety training into their regular activities, these groups can establish some form of peer support systems for women, empowering them to share experiences, alert others of fraudulent activities, and build confidence in combating the threats.

Design for more Inclusion and Safety: Financial

services must be designed in ways that deeply understand the needs, behaviors, and contexts of low-literacy female users; adopting user-centered and inclusive design principles. It implies commitment to:

- Simplicity and Familiarity: Interfaces should be intuitive, using clear visual cues, voice prompts, and local languages to reduce cognitive load and minimize chances of error. Significantly lowering the learning curve with adherence to established design patterns that users are already accustomed to with other applications.

- Ethnographic Research: Going beyond surveys, financial service providers have to invest in ethnographic studies observing women conducting their finances in daily life. Only then will deep insight into their pain points, fears, and aspirations be possible to build relevance and trust into products.

Harness Technology for Proactive Protection:

Advanced technology should be deployed to create a safer environment for all users. This includes:

- Biometric Verification: Greater security can be achieved when strong biometric verification systems (fingerprint or facial recognition) are used during onboarding and for transaction approvals. Less reliance is placed on PINs or passwords because these can be easily stolen during social engineering attacks.

- AI-Powered Fraud Monitoring: Financial institutions could employ the use of artificial intelligence and machine learning not just for credit scoring but for real-time transaction monitoring. These systems must be trained on gender-disaggregated data to effectively identify anomalous patterns specific to female users.

- Secure Infrastructure: Critical infrastructure widely used by women for market transactions, such as the USSD platforms, need to be upgraded with enhanced secure infrastructure to prevent interception and other imperfections.

Trust: A Call to Redesign

Technology alone cannot eliminate fraud. Real change requires empathy. We must listen to how women describe fear, understand what safety means to them, and design solutions that respect their lived realities.

Ultimately, this work is about dignity, confidence, and women’s right to participate in a digital world without fear.

Reference List

- Ernest, Blessing. “West Africa’s Economy: The Critical Role of Innovation and Entrepreneurship.” African Leadership Magazine, 19 Jan 2024. Link

- The World Bank Group. For Women, By Women, With Women: Bridging the Gender Digital Divide. Final Report. ©2022. [PDF]. Link

- GSMA. “Closing the Mobile Gender Gap in Sub-Saharan Africa: A Social and Commercial Opportunity.” 9 Apr 2025. Link

- CGAP. (2022). Break the Bias: Evidence Shows Digital Finance Risks Hit Women Hardest. Link

- D+C (Development and Cooperation). “Digital Fraud: Major Challenge in Africa.” Link

- Women’s World Banking. “Report: Empowering Nigeria’s Women Micro-Entrepreneurs – Actionable Insights for Financial Services Providers.” Link

- UNCDF Policy Accelerator. “What’s New: DFS Actions to Increase Inclusion & Protection.” Link

- National Center for Biotechnology Information (PMC). “Article Title (PMC5806049).” [Article]. Link

- U.S. Bureau of Labor Statistics. “Women’s Earnings Were 83.6 Percent of Men’s in 2023.” TED: The Economics Daily, 2024. Link

- The World Bank Blog. “Transforming Futures: Digital Skills for Girls and Women in Northern Nigeria.” Link

Author

-

is a skilled UX researcher and designer with a solid foundation in design and research, combined with exceptional strategic thinking, dedicated to creating products that align with user needs and business objectives.

View all posts