In the dynamic landscape of Nigerian fintech, innovation thrives. Yet, a significant number of startups falter, not due to a lack of funding or ideas, but because they overlook a fundamental principle: understanding the real needs of their users. This is where user research in Nigerian fintech becomes crucial. It helps uncover the cultural, emotional, and practical realities that shape financial behaviors. This aligns with CB Insights’ 2021 Startup Failure Report, which cites no market need as the number 1 reason why startups fail globally, accounting for 35% of all failures.

When fintechs design based on assumptions rather than research:

- Adoption rates stay low despite marketing spend

- Trust is lost due to unmet cultural or emotional expectations

- Negative reviews/feedback. Consequentially, word-of-mouth works against the product

- Users struggle with confusing interfaces.

What user research in Nigerian fintech revealed about saving and borrowing

A new Fintech in Nigeria, proposes to launch ‘Flatvault’ with the goal of modernizing savings and borrowing for young adults in Nigeria. The founders envisioned a future where digital wallets and micro-loans would swiftly replace traditional practices like ajo (group savings) and informal borrowing networks. Running with the assumption that Digital financial tools are replacing informal saving and borrowing methods, we took a dive into user research for Flatvault, we identified that this assumption was only partially true, with data painting a much more nuanced picture.

Based on a survey of 42 Nigerian fintech users aged between 18-44, representing a diverse range of employment statuses-including full-time employees, self-employed individuals, part-time workers, unemployed respondents, and students, several clear patterns emerged regarding their experiences and behaviours with fintech apps:

Digital Savings Tools Have Been Widely Adopted: When it comes to saving money, digital apps have become the most popular option, with 25 out of 42 respondents (59%) using them most often in the past six months. Traditional bank accounts are still relevant, chosen by 9 people (21%), while local savings groups like ajo or esusu remain important for 5 respondents (12%). A small group (3 respondents) still prefer saving cash at home.

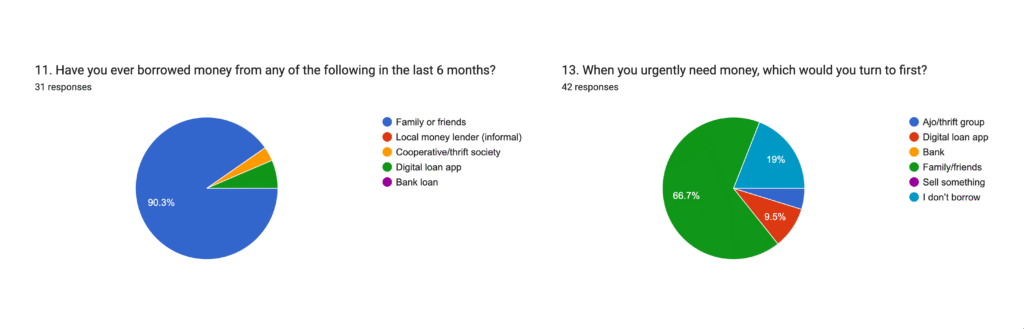

Borrowing Remains Deeply Informal: Borrowing habits, however, remain deeply rooted in informal networks. Data showed that, of the 31 participants who had borrowed money in the past six months, 28 (90%) turned to family or friends, while only 2 used a digital loan app and 1 borrowed from a cooperative or thrift society. Notably, no one reported borrowing from a traditional bank.

Key Takeaway

The user research in Nigerian fintech reveals that while digital savings tools have become mainstream (used by nearly half of respondents), informal methods; especially for borrowing remain deeply embedded in Nigerian society. Most users still rely on trusted social networks for urgent financial needs, and only a minority (20%) see digital tools fully replacing these systems anytime soon.

- Fintech solutions that digitize familiar structures (like ajo or peer lending) while improving security and transparency may stand a better chance at adoption because 64% of the participants indicated a continuous reliance on traditional support networks.

- Informal borrowing is often used to meet urgent needs quickly, fintechs that replicate this speed and flexibility will be more useful and trustworthy.

- Traditional group savings systems like ajo thrive on trust, and social accountability, factors often missing in formal banking processes.

Startups like Flatvault must recognize that true innovation means integrating with, not simply replacing these trusted systems.

A single decision to launch into the market based on the assumption that digital financing tools are replacing tradition borrowing methods would have resulted in several consequences to business for ‘Flatvault’. These insights underscore the importance of grounding fintech solutions in the lived experiences of users.

The Path Forward

Impactful innovation happens when fintech companies recognize the complexity of financial behaviours; blending the convenience of digital tools with the trust, community, and flexibility that have long underpinned informal/traditional systems. Rather than trying to erase traditional practices, the opportunity lies in enhancing and re-imagining them for the digital age.

Success in Nigeria’s dynamic fintech landscape demands far more than assumptions about “digital readiness” or hopes that traditional practices will simply vanish. It requires a deliberate shift: from designing for hypothetical users to designing with a deep, empathetic understanding of real users’ daily realities.

By designing solutions that are inclusive, accessible, and rooted in empathy, fintechs can not only achieve higher onboarding, adoption and retention rates, but also foster deeper user loyalty and long-term market relevance.

The future of Nigerian fintech belongs to companies who act beyond assumptions, listen closely to their users, and design products that not only meet people’s needs, but meet them where they are.

Author

-

is a skilled UX researcher and designer with a solid foundation in design and research, combined with exceptional strategic thinking, dedicated to creating products that align with user needs and business objectives.

View all posts