Products that scale in Africa do so by designing for reality, not assumptions. Health-tech platforms built for offline-first use report nearly double retention in rural areas, while fintechs that prioritize mobile money and bank transfers consistently outperform card-centric checkouts on conversion across markets like Nigeria, Kenya, and Ghana (InclusionTimes, 2024).

Understanding why established UX practices underperform in African markets requires examining the gap between designer assumptions and user realities. This matters because technology adoption across the continent depends on interfaces that genuinely serve local needs rather than importing solutions optimized for Western markets.

In this article, we’ve highlighted 4 market realities that differentiate African UX requirements from Western best practices: connectivity constraints, device economics, payment ecosystems, distribution channels, and research methodologies. For each constraint, we identify the business impact of misalignment and provide implementation frameworks used by organizations serving millions of African users. The strategic question isn’t whether to adapt; it’s how to build market-specific design into your development process without sacrificing speed to deployment. The path forward combines deep contextual research with adaptive design principles while centering African designers and users to ensure products reflect lived experience rather than external projections.

The Connectivity Assumption: When Offline-First Isn’t Optional

Designers accustomed to reliable broadband often treat offline functionality as an edge case rather than a primary consideration. Consequently, many applications fail before users complete basic tasks in African markets. Research from GSMA Intelligence shows that 3G and 4G coverage reaches only 84% and 64% of Sub-Saharan Africa’s population, respectively (GSMA, 2024). Additionally, network reliability fluctuates significantly throughout the day as infrastructure strains under peak demand. Therefore, building offline-first UX is not optional but critical for reaching new markets and sustaining user retention.

Key offline-first practices include:

- Caching critical user data locally on devices

- Designing single-screen workflows that minimize server calls

- Providing clear visual indicators of connection status

- Building graceful degradation into feature hierarchies

- Testing extensively on 2G networks under real-world conditions

These adaptations transform accessibility from theoretical best practice into functional necessity.

Limitations with Devices: Optimizing for Entry-Level Hardware

Assuming that users have recent smartphone models with ample storage and processing power excludes significant market segments across African countries.

Budget Android devices dominate the continent’s mobile landscape, often operating with limited storage. Therefore, applications exceeding ~20MB face deletion as users manage storage scarcity by removing less essential apps. Battery life also influences design decisions, and as a result, resource-intensive features drain power quickly, creating friction in markets where electricity access remains inconsistent.

A lightweight application architecture prioritizes essential functionality over feature abundance. Kenya’s M-Shwari banking service, for example, delivers core savings and loan transactions through a highly focused interface that minimizes data and device strain, reflecting a design philosophy that respects user constraints while delivering genuine utility (FSD Africa, 2025).

Device optimization requires:

- Compressing image assets and using vector graphics

- Minimizing background processes and animations

- Testing on low-RAM devices to validate worst-case performance

- Designing for battery efficiency through reduced screen brightness and processing demands

The Payment Infrastructure Gap: Rethinking Transaction Flows

Standard e-commerce checkout processes assume high credit-card penetration and mature digital‑banking infrastructure, which do not fully reflect African financial ecosystems. Across much of the continent, cash and mobile money platforms such as M‑PESA, MTN Mobile Money, and Airtel Money remain dominant payment methods, especially in online and semi‑digital transactions (GSMA, 2024; Marketdataforecast, 2025). When international UX frameworks position these systems as secondary options rather than core payment methods, users often encounter unfamiliar or poorly integrated gateways at checkout, which can increase cart abandonment and limit market reach.

Payment integration must prioritize locally dominant platforms over international standards. Jumia, Africa’s largest e-commerce platform, succeeded by making mobile money and cash-on-delivery default options while treating card payments as alternatives. Additionally, the platform designs for USSD payment flows that work without smartphone apps.

Effective payment UX considers:

- Integrating mobile money APIs as primary payment methods

- Supporting cash-on-delivery with clear delivery tracking

- Designing for USSD transaction confirmation workflows

- Minimizing payment steps to reduce abandonment

- Providing familiar trust signals specific to local payment habits

The Infrastructure Reality: Distribution Channels and App Discovery

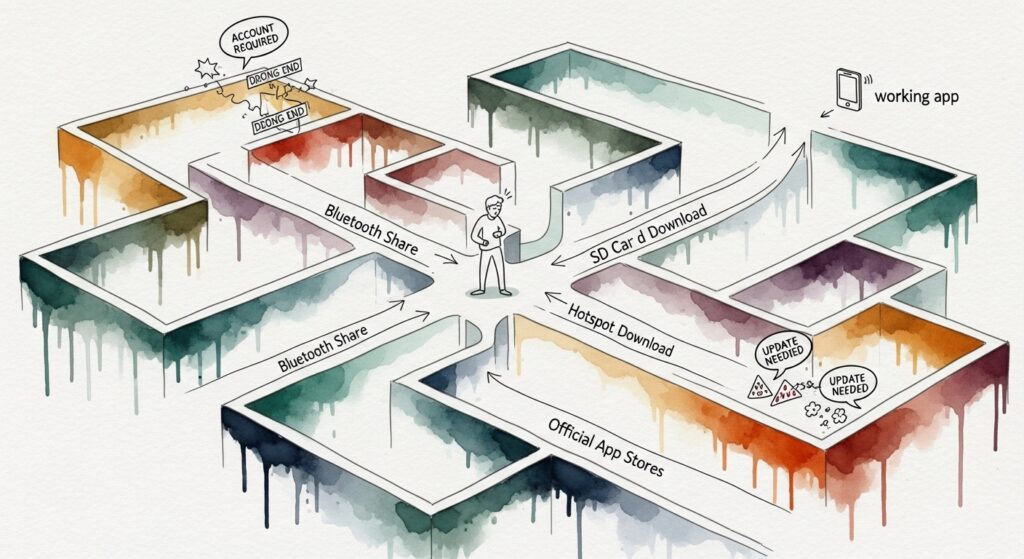

Conventional app store optimization strategies assume reliable WiFi for downloads and automatic updates that conflict with African user behaviors.

Many users discover apps through offline channels; Bluetooth sharing, SD card transfers, and WiFi hotspot exchanges dominate in environments where data costs prohibit casual browsing. Consequently, applications must function immediately after installation without requiring additional downloads or account creation.

Lightweight APK files travel more readily through peer networks, expanding reach beyond official app stores. Additionally, designing for immediate utility without mandatory sign-ups reduces friction when users receive apps through informal channels.

Distribution strategies include:

- Creating standalone APK files under 10MB

- Enabling core functionality without account creation

- Designing for sideloading and offline installation

- Building referral incentives into peer sharing

- Testing discovery through informal distribution channels

How Do We Navigate Past These Extractive Design Practices

International design firms and global organizations that conduct brief research visits and that treat African users as data sources rather than collaborative partners in the design process would produce superficial insights while missing deeper contextual understanding through this extractive approach. Furthermore, this kind of research often fails to account for regional diversity across the continent’s 54 countries and thousands of ethnic groups.

1. Establishing Collaborative Research Partnerships: To navigate these practices, institutions can adopt a more strategic, partnership‑driven model: establishing long‑term collaborative research partnerships with local design communities, co‑creating with African studios, and centering local expertise throughout the design life cycle. These collaborations surface insights that external teams miss during brief research visits and help institutions build products that are not only locally relevant but also scalable across diverse African markets. Most critically, these partnerships must prioritize building capacity within African design teams rather than extracting knowledge, transforming what could be transactional research into collaborative capability development that strengthens local ecosystems while delivering superior market intelligence.

2. Adopting Effective Research Approaches: Effective research approaches begin with employing local researchers who understand linguistic and cultural nuances that external teams often miss. Rather than extractive site visits, institutions should conduct longitudinal studies that track usage patterns over time, revealing behavioral insights that shape sustainable product-market fit. Fair compensation for research participants demonstrates respect for their expertise and time, while sharing research findings with local communities builds trust and reciprocal learning.

The opportunity lies in creating products that genuinely serve diverse user populations while achieving commercial success. International firms contribute most effectively through collaborative partnerships that defer to local expertise rather than imposing external frameworks. Therefore, investing in African design talent and building for actual constraints transforms perceived limitations into competitive advantages, driving adoption and revenue.

References

- InclusionTimes (2024). Paystack 2023: Payment trends in Africa.

- GSMA Intelligence (2024). The Mobile Economy Sub‑Saharan Africa 2024.

- FSD Africa (2025). The growth of M‑Shwari in Kenya – a market development story.

- Marketdataforecast (2025). Africa Mobile Payments Market Size, Share & Growth, 2024-2033.

Author

-

is a skilled UX researcher and designer with a solid foundation in design and research, combined with exceptional strategic thinking, dedicated to creating products that align with user needs and business objectives.

View all posts